Lecture 5 - 9/14/99

Income Effects from Rand Study

-

Income elasticity of demand 0.2 or less

-

These estimates hold technological change constant (also true for price

elasticities)

-

Income elasticities from aggregate, cross-country studies over 1.0

Aggregate Cross-Country Studies (pp. 608-10, Phelps)

-

Health expenditure per capita = -290 + 0.1 (per capita income)

-

(t=3.5) (t=14.3)

N=24 , elas.=1.35

-

Log (per capita spending) = -10.2 + 1.8[log(per capita

income)]

-

(t=10.0) (t=17.0)

N=24 , elas.=1.8

Demand for Health Insurance

-

Refer to Phelps, Chap. 10

-

Health insurance is one of many insurances--third party v. first party

insurance

-

Demand for health insurance related to demand for health care services

-

Like all other goods, demand for insurance depends on its "own" price

Concepts of Price of Insurance and Expected Loss

-

Expected loss: EL=(1-p)*0 + p*L

-

Expected loss=actuarial value of loss

-

Example: let p=..025, L=$8,000, then EL= .975*0+.025*8,000=$200

Risk Aversion Graph

Model of Demand for Insurance: Initial Assumptions

-

A1: Individual maximizes his/her utility

-

A2: Loss fixed at $* if in sick state

-

A3: Probability of loss fixed

-

A4: Individual chooses between two courses of action: (1) buy insurance

and thereby incur small certain loss in form of insurance premium or (2)

self-insure and thereby face a large loss if sick and large probability

of no loss

-

A5: Decreasing marginal utility of income (wealth)--same as risk aversion

-

Let W3 = $10,000 (if well and self-insure); W2 = $9,800 (if insure); W1

= $2,000 (if sick and self-insure); $200 is actuarial value of loss

-

At W3, U=100; at W2, U=99; at W1, U=20

-

Then EU= .025*20+.975*100=98. But U =99 >EU=98

Expected Utility Graph

-

Can find expected utility (EU) by drawing a straight line from end points

-

A-B represents the additional amount insurance company could extract from

the individual and make him as well off as self-insuring.

-

The more curvature the “certainty” curve has, the more risk averse the

individual is

Interpret the Cord from Expected Utility Graph

-

See why cord is a straight line. Given U(W1) and U(W3) fixed, expected

utility varies linearly

-

Example: say p=.05, then EU=.05*20+.95*100=96; if p=.1, EU=.1*20+.9*100=92;

if p=.15, EU=.15*20+.85*100=88. etc.

-

If increase p, EL also up and W3-W2 up--see W2*

-

If utility in the healthy state is increased, slope of cord becomes steeper

and closer to the certainty curve. To see this, make U(W3)=120 (instead

of 100)

-

Again, if have constant MU of wealth, certainty curve and cord coincide.

Then, there can be no demand for insurance

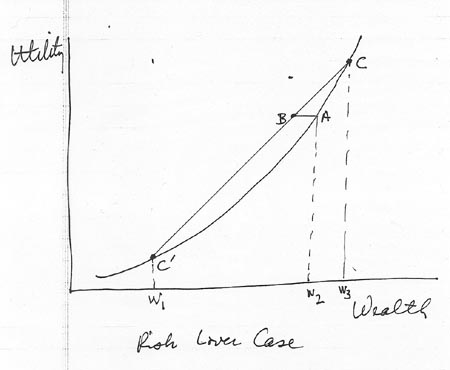

Risk Lover Graph

Risk Lover Case

-

In this case, MU of wealth increases with increased wealth

-

Certainty curve becomes convex to wealth (X) axis and cord on other side

of curve.

-

Line to cord represents amount willing to pay for opportunity to gamble

-

Friedman and Savage (1948)--people have risk loving (when poor) and risk

averse regions (when nonpoor)

Determinants of Demand for Insurance

-

Characteristics of service. More demand for service to be covered

if (1) probability of loss in mid-range, (2) possible expenditure loss

high, (3) price elasticity of demand for service is low

-

Adverse selection (expected use of service)

-

Loading

-

Tax subsidy (varies with marginal tax rate)